Tripoli, July 2, 2025 – Libya has launched its first competitive oil‑and‑gas exploration tender since the 2011 uprising, signaling a renewed commitment to rejuvenate its energy sector and invite global investors.

International InterestA total of 37 companies, including major players like Chevron Corp., Total Energies SE, Eni SpA, and Exxon Mobil, have submitted bids for exploration rights, according to National Oil Corporation (NOC) Chairman Massoud Seliman. The competition marks a significant return of foreign capital to Libya’s oil‑rich fields

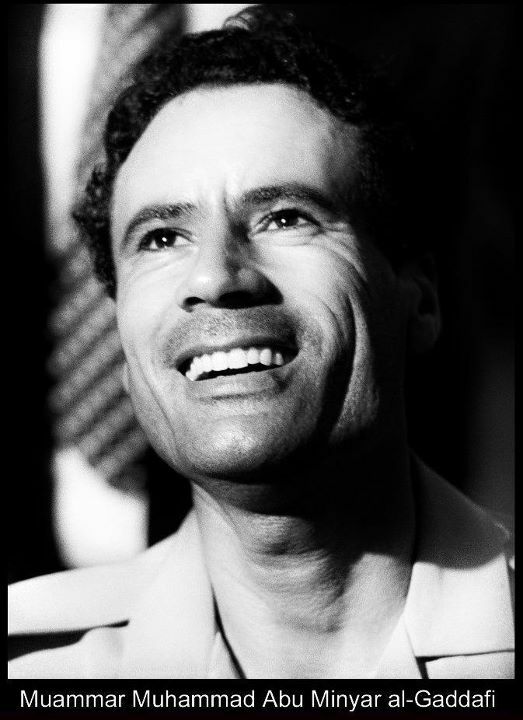

⏳ A First Since the Qaddafi EraThis tender is Libya’s first licensing round since 2007, before the fall of Muammar Qaddafi in 2011, and the first auction since the conflict that fractured the nation. It represents a turning point, aiming to reclaim investor confidence after years of instability .

🚀 Ambitious Production Goals

💡 Risk‑Reward Model in PlayUnder the new terms, companies must initially fund exploration and seismic surveys. If a viable reservoir is found, they are permitted to recoup costs later, providing a shared‑risk framework attractive to both Libya and investors africa.businessinsider.com.

🏁 What Comes Next?NOC Chairman Seliman revealed that the State Oil Company is awaiting green light for the development budget. Once approved, the company will begin:

⏳ A First Since the Qaddafi EraThis tender is Libya’s first licensing round since 2007, before the fall of Muammar Qaddafi in 2011, and the first auction since the conflict that fractured the nation. It represents a turning point, aiming to reclaim investor confidence after years of instability .

🚀 Ambitious Production Goals

- Current output: ~1.4 million barrels per day (bpd)

- Target for 2030: 2.0 million bpd

- Pre‑2011 peak: 1.75 million bpd in 2006

💡 Risk‑Reward Model in PlayUnder the new terms, companies must initially fund exploration and seismic surveys. If a viable reservoir is found, they are permitted to recoup costs later, providing a shared‑risk framework attractive to both Libya and investors africa.businessinsider.com.

🏁 What Comes Next?NOC Chairman Seliman revealed that the State Oil Company is awaiting green light for the development budget. Once approved, the company will begin:

- Rolling out the tender winners into exploration projects

- Accelerating development at key joint ventures

- Progressing toward the 1.6 million bpd output target within a year